ITR 3 Form

ITR-3 Form:

ITR-3 is a new form introduced this year by the income tax department and substitute of old ITR-4 form which is to be used by individuals and HUFs for filing income tax returns.

Eligibility for ITR-3 Form:

This income tax return form is used by HUFs and individuals which come under these following categories:

- Partnership in a firm.

- Income by a means of interest, salary, bonus, remuneration, commission as a partner.

- Income through Profits or Gains of business or profession.

Structure of ITR-3 Form:

Part-A: General Information

Part-A-BS: Balance Sheet as on 31st day of March,2017 of the proprietory business or profession.

Part-A-P & L: Profit and Loss Account for the financial year 2016-17

Part-A-OI: Other Information

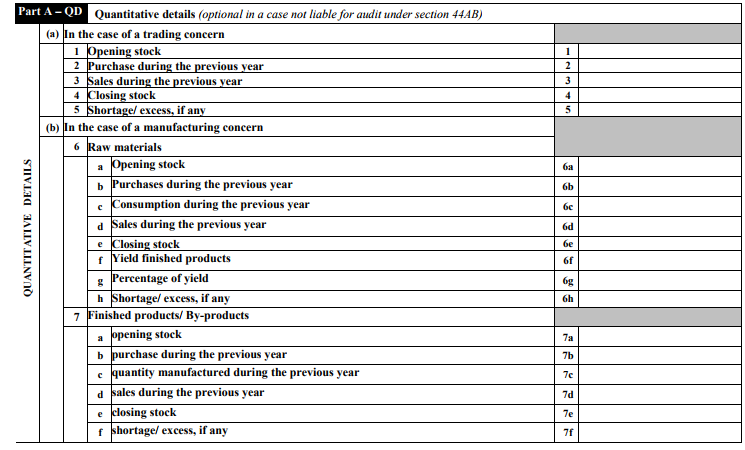

Part-A-QD: Quantitative Details

Part-B-TI: Computation of Total Income

Part-B-TTI: Computation of tax liability on total income.

Verification

SCHEDULES OF THE RETURN FORM:

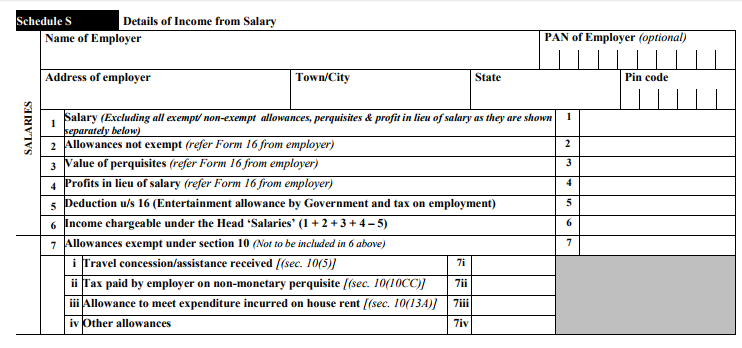

Schedule S: Details of Income from Salary

Schedule HP: Details of Income from house property

Schedule BP: Details of Income from business or profession.

Schedule DPM: Depreciation of plant and Machinery

Schedule DOA: Depreciation on other assets.

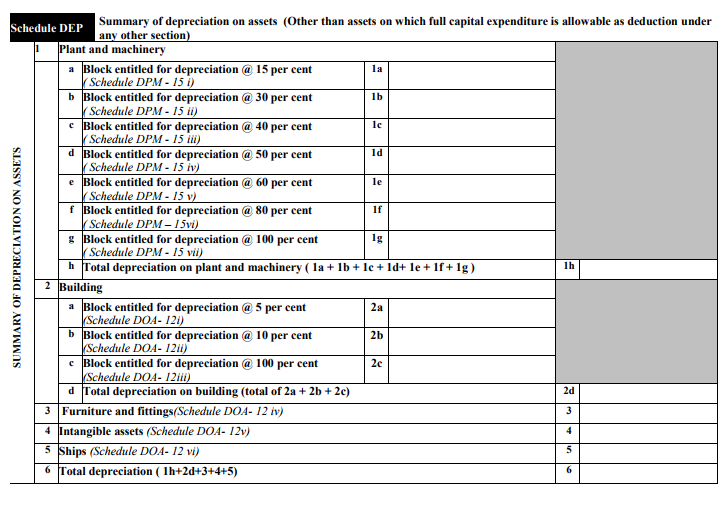

Schedule DEP: Summary of depreciation on assets.

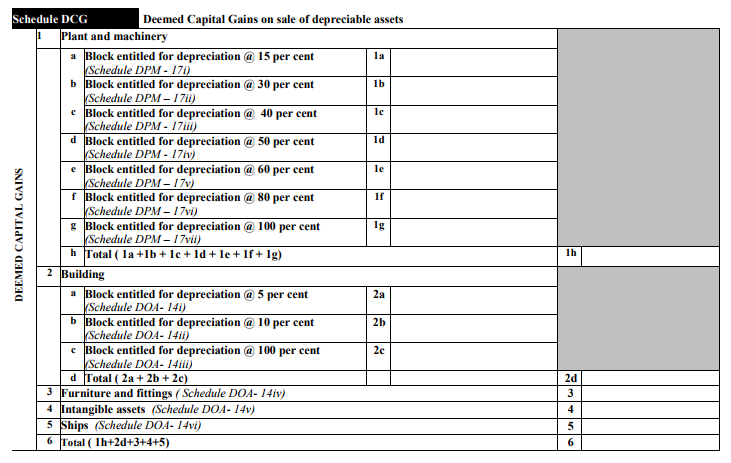

Schedule DCG: Deemed Capital gains on sale of depreciable assets

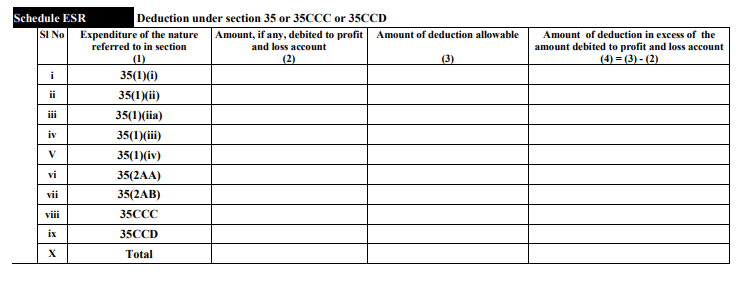

Schedule ESR: Deduction under Section 35 or 35CCC or 35CCD

Schedule CG: Capital Gains

Schedule OS: Income from other sources.

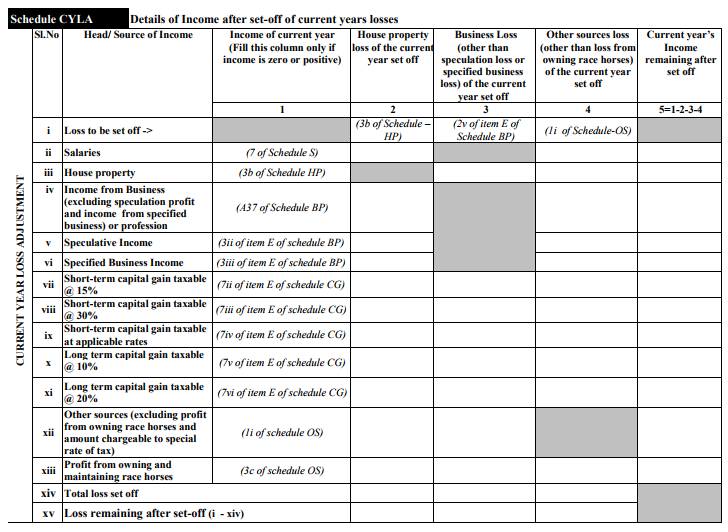

Schedule CYLA: Details of income after set-off of current years losses

Schedule BFLA: Details of income after set-off of brought Forward losses of earlier years.

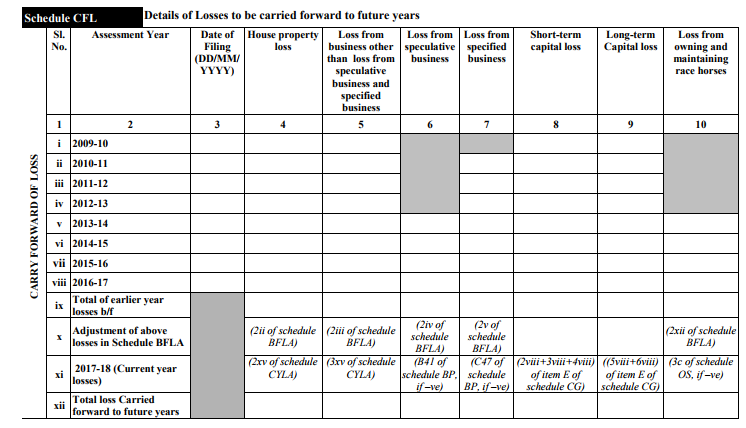

Schedule CFL: Details of losses to be carried forward to future years.

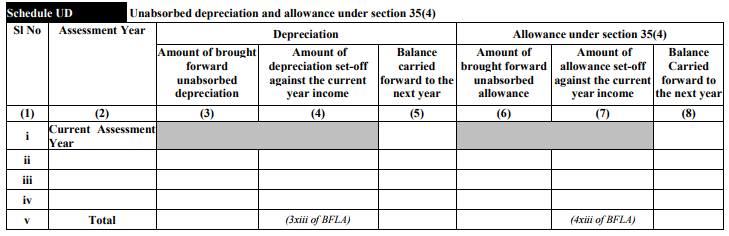

Schedule UD: Unabsorbed depreciation and allowance under section 35(4)

Schedule ICDS: Effect of income computation Disclosure standards on profit.

Schedule 10A: Deduction under Section 10A

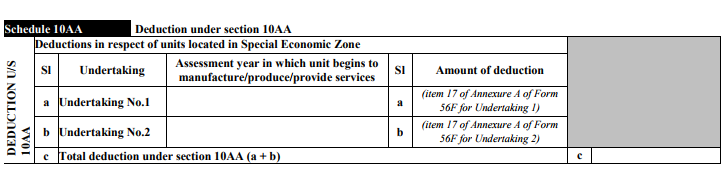

Schedule 10AA: Deduction under Section 10AA

Section 80G: Details of donations entitled for deduction under Section 80G.

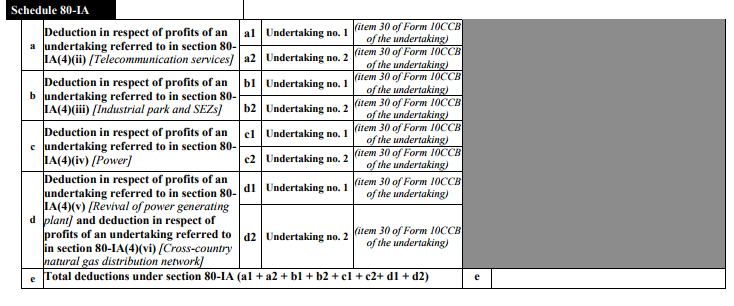

Schedule 80-IA

Schedule 80-IB

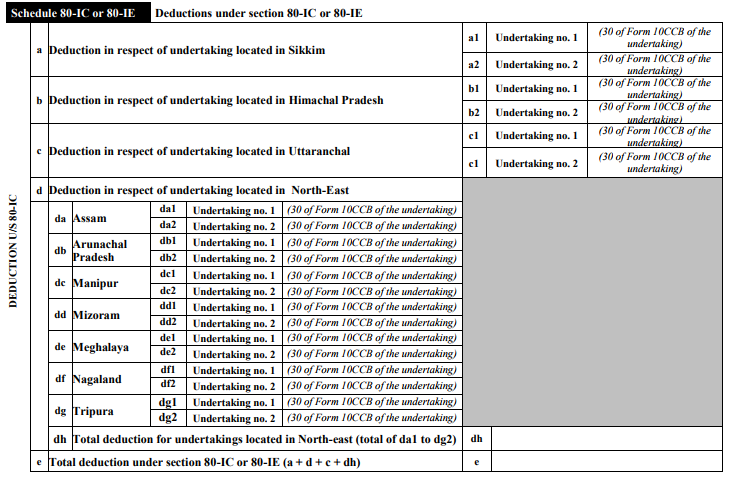

Schedule 80-IC or 80-IE

Schedule VI-A

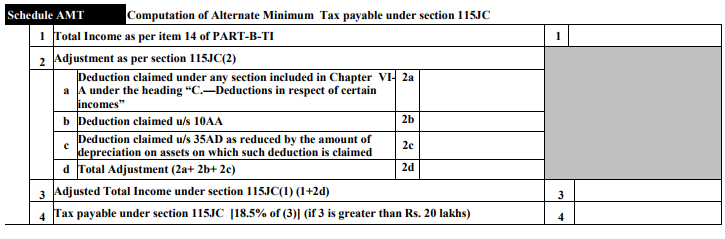

Schedule AMT: (Computation of Alternate Minimum Tax payable under section 115JC)

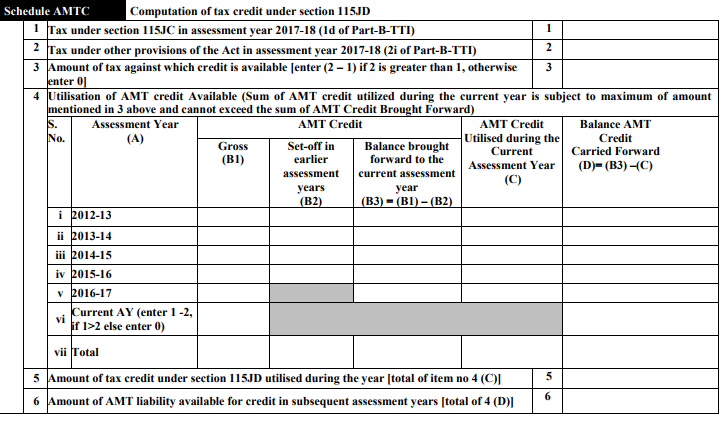

Schedule AMTC: (Computation of tax credit under Section 115JD)

Schedule SPI

Schedule SI: (Income chargeable to tax at special rates)

Schedule IF: (Information regarding partnership firms in which you are partner

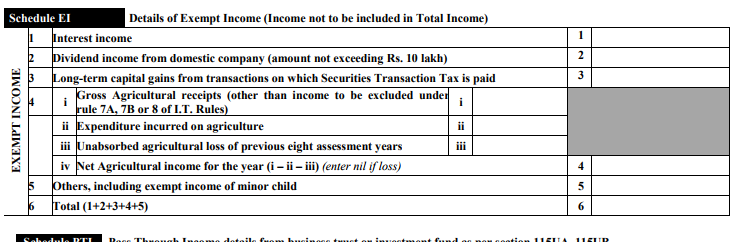

Schedule EI: Details of Exempt Income

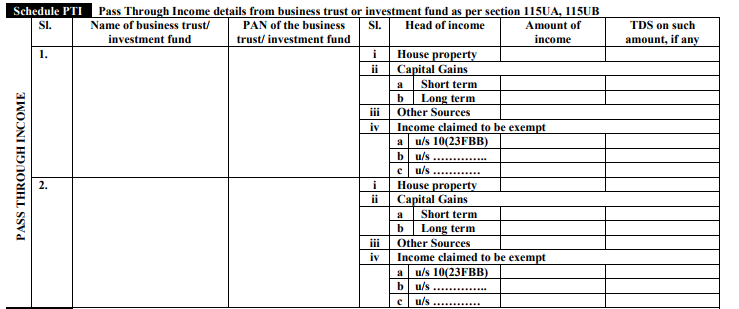

Schedule PTI: Pass through income details from business trust or investment fund as per section 115UA,115UB

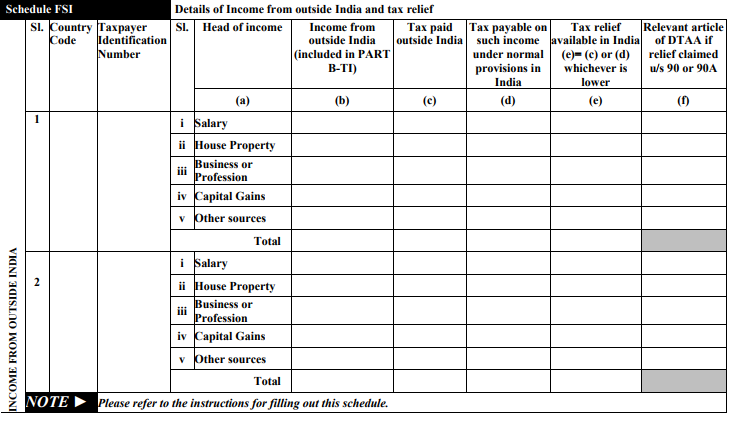

Schedule FSI: Details of income from outside India or tax relief

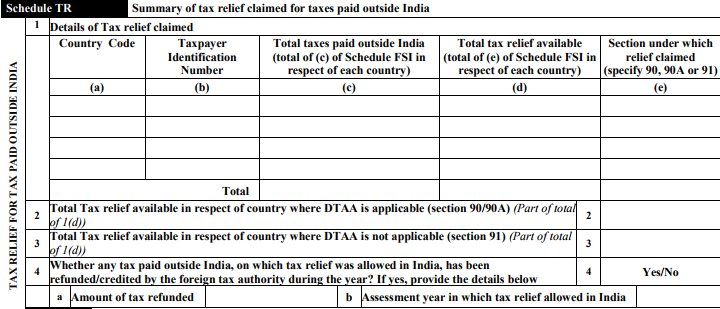

Schedule TR: Summary of tax relief claimed for taxes paid outside India

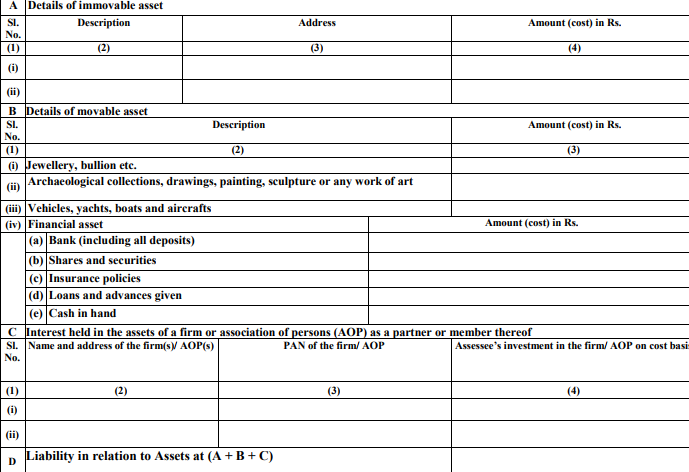

Schedule FA: Details of foreign assets from any source outside India

Schedule 5A

Schedule AL: Asset and Liability at the end of the year (other than those included in Part-A-BS) (applicable in a case where total income exceeds Rs.50 lakh)

Email already exists.