Form 26AS (Tax Credit)

Form 26AS or tax credit statement gives you all the important details of taxes you have paid.

You should check it before filing your tax return which will help you in eliminating any errors in tax calculation to file an accurate return.

Avoid last minute mistake while filing income tax returns: Tax filing mistakes

Form 26AS also called Annual Statement, is a consolidated tax statement which has all tax related information (TDS, TCS, Refund etc) associated with a PAN. It shows how much of your tax has been received by the government and is consolidated from multiple sources like your salary / pension / interest income etc. This form contains the annual tax statement under Section 203AA and Rule 31AB. This article explains Form 26AS in detail with images.

The due date for filing income tax return is nearing which is 31st July so you need to know about the various important documents required in details for filing your income tax returns.

Checklist of documents required for E-filing income tax return: Documents required

Importance of Form 26AS

Tax Credits appearing in Part A, A1 and B of the Annual Tax Statement are on the basis of details given by deductor in the TDS or TCS statement filed by them. The same should be verified before claiming tax credit and only the amount which pertains to you should be claimed. Form 26AS, what exactly to verify in Form 26AS with the Form 16, Form 16A issued and Advance Tax, Self Assessment Tax paid.

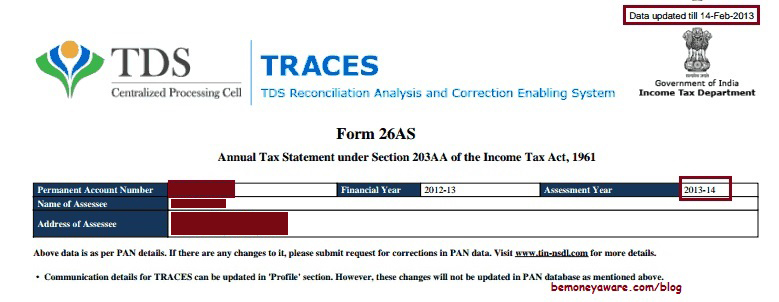

Overview of Form 26AS

- Form 26AS will be generated whenever tax related transaction(TDS deducted,Advance tax paid) happens in relation to the tax payer. It is a live document which is updated as the transactions are reported / processed for the given FY.

- Only a registered PAN holder can view their Form 26AS on TRACES. You can view your Form 26AS in TRACES from AY 2009-10 onwards or from FY 2008-09 onwards.

- The address reflecting in Annual Tax Statement (Form 26AS) is picked up from Income Tax Department’s PAN database with the details of latest PAN card issued to you

- The password for opening Form 26AS will be your Date of Birth (in DDMMYYYY format), e.g., if your date of birth is 03-Feb-1981, password will be 03021981.

Structure of Form 26AS

The Form 26AS (Annual Tax Statement) for an Assessment Year is divided into parts described below

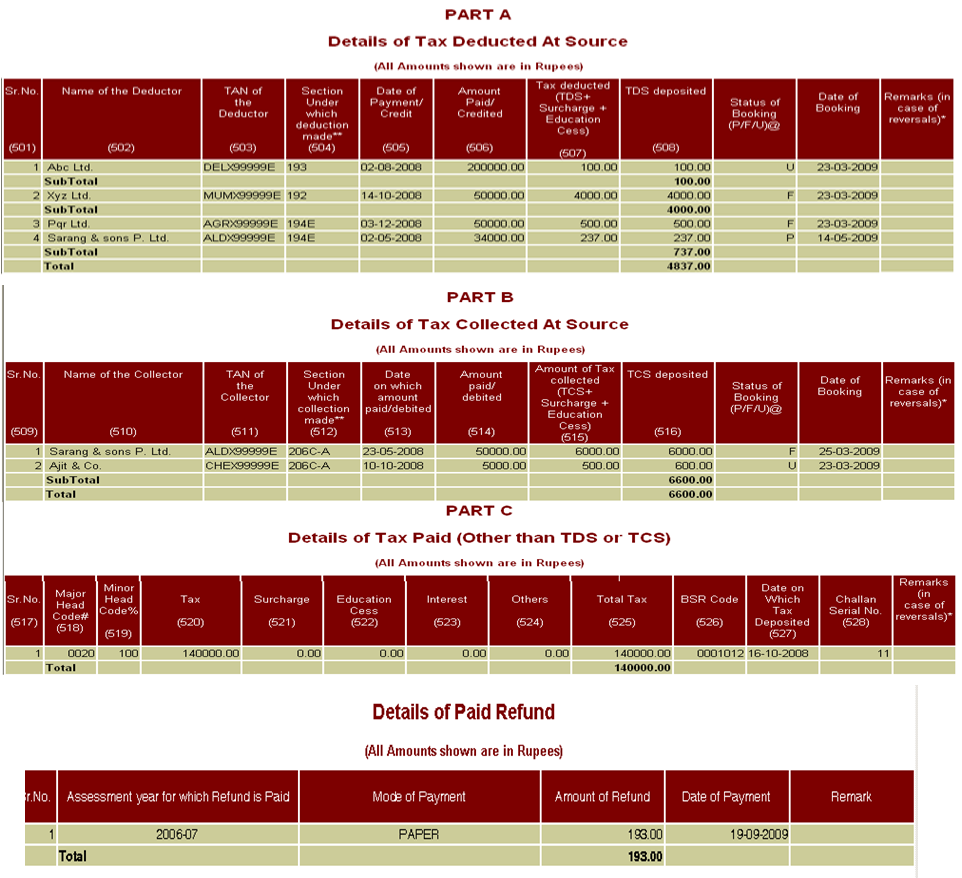

PART A- Details of Tax Deducted at Source (All amount values are in INR)

This section will show the TDS deducted from your salary / pension income and also TDS deducted by banks on your interest income. TDS deducted by each source is shown as a separate table

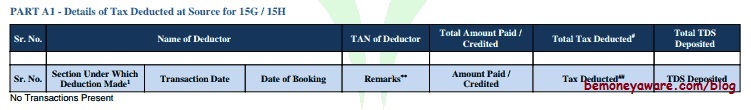

PART A1- Details of Tax Deducted at Source for 15G / 15H

This section will show transaction in those financial institutions such as banks where the individual has submitted Form 15G / 15H. TDS in these cases would be zero (because you have submitted 15G/15H).This section enables you to keep a track of all the interest gain which has not been taxed.

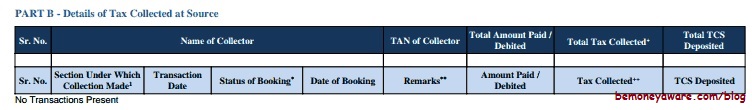

PART B- Details of Tax Collected at Source:

Tax Collected at Source (TCS) is collected by the seller from the buyer at the time of sale of specified category of goods(such as Alcoholic liquor for human consumption,Scrap,Parking lot, Toll plaza). The TCS Rate vary for each category of goods and the TCS is to be deposited with the govt.

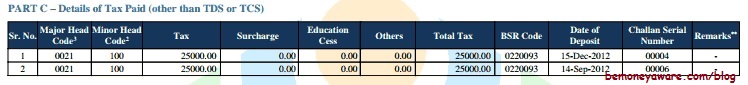

PART C– Details of Tax Paid (other than TDS or TCS)

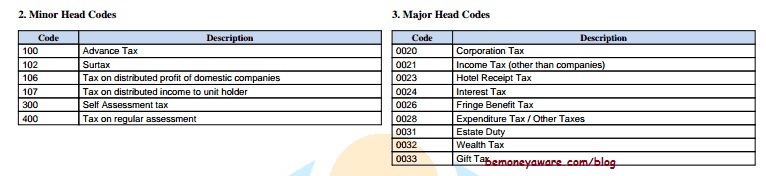

If you have paid Advance Tax or Self Assessment Tax, this will be listed here, Whenever you deposit your advance tax / self assessment tax directly to bank, the bank will upload this information around three days after the cheque has been cleared. Major and minor head codes used in Part C are given in image below. For Individual major code is 0021 and minor codes are 100 for Advance Tax and 300 for Self Assessment Tax.

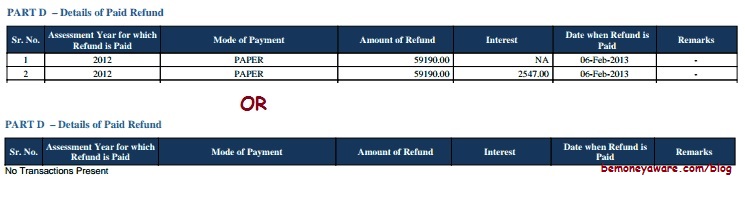

PART D – Details of Paid Refund

If you have got any tax refunds in that assessment Year it would be listed under this section.

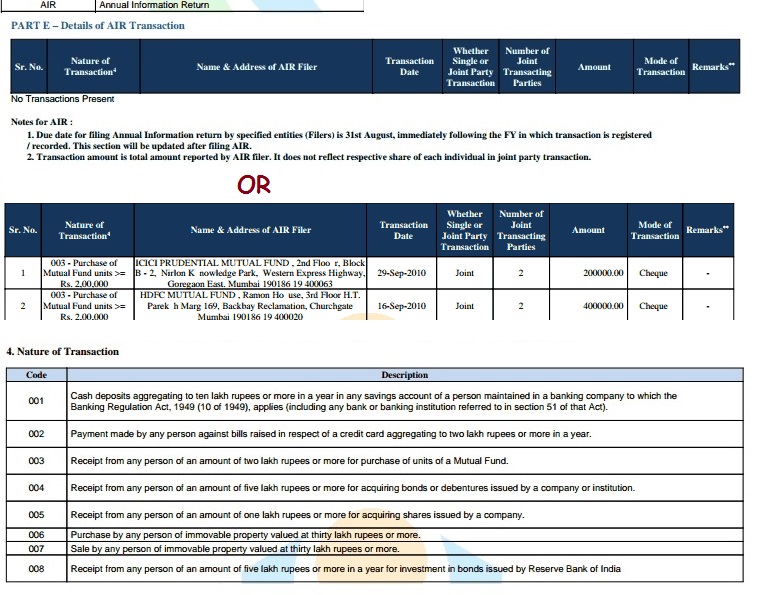

PART E – Details of AIR Transaction

If you make some high value transactions, such as investment in property and mutual funds, then these transactions are automatically reported to the income tax department by banks and other authorities through Annual Information Return (AIR)

Form 26AS looks different from earlier versions?

Yes it does. Earlier version of form is shown below. The change is due to agency which maintains the information. Earlier the information was maintained by TIN NSDL but now it is maintained by TRACES. Though look and feel is different Information reported is similar (Part A1 for tax saved by submitting Form 15H/15G was missing in earlier versions of Form 26AS) . Click on image to enlarge

Introduction

This statement does not include payments pertaining to Assessment Year (AY) other than the AY mentioned above and payments against penalties

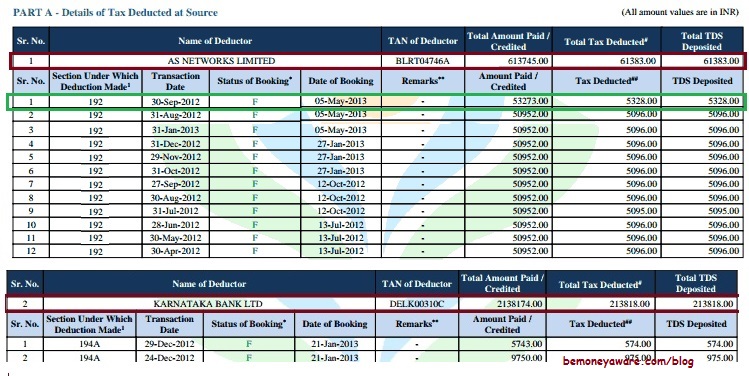

PART A of Form 26AS

TDS deducted by each source is shown as a separate table as shown in image below. Entries are in reverse chronological order that means entry wth date later will appear first. So if you have entry for date 31-Jul-2012, 31-Aug-2012, 30-Sep-2012 then they will appear as 30-Sep-2012 31-Aug-2012 31-Jul-2012. Please verify that

- Details of deductor match your Form 16,Form 16A.

- All entries for a deductor match the entries in your Form 16/16A. Check each entry for Section Under Which Deduction is made (192 for Salary, 193 for interest on Fixed Deposit from bank) , Date at which Transaction is made, Status of Booking.

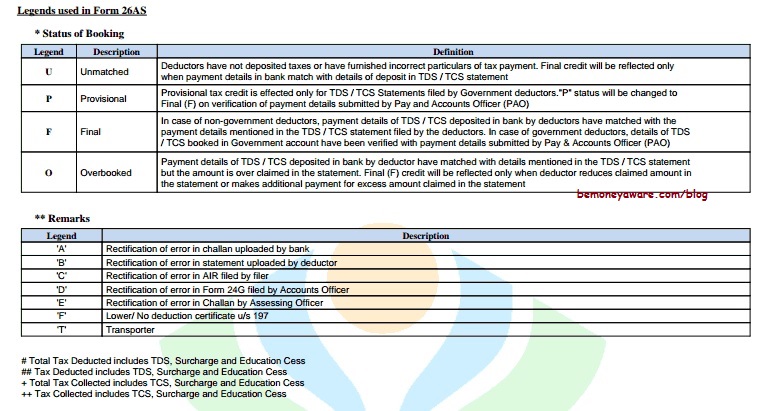

- Status of booking is F or FINAL which shows that payment details of TDS / TCS deposited in bank by deductors have matched with the payment details mentioned in the TDS / TCS statement filed by the deductors.

Status of Booking :Various codes for Status of Booking are given below. Status of Booking should be F

Please contact the deductor to update details if :

- Some entry(s) is missing.

- If Status of Booking is U which means Unmatched . It means Deductors have not deposited taxes or have furnished incorrect particulars of tax payment. Final credit will be reflected only when payment details in bank match with details of deposit in TDS / TCS statement.

Part A1 of Form 26AS

This section will show transaction in those financial institutions such as banks where the individual has submitted Form 15G / 15H. TDS in these cases would be zero (because you have submitted 15G/15H). This section enables you to keep a track of all the interest gain which has not been taxed. If you have not submitted Form 15G/15H then there will no entries in this section and it will show No Transactions Present

Part B of Form 26AS

Tax Collected at Source (TCS)is collected by the seller from the buyer at the time of sale of specified category of goods(such as Alcoholic liquor for human consumption,Scrap,Parking lot, Toll plaza). The TCS Rate vary for each category of goods and the TCS is to be deposited with the govt. If you have not collected any tax then there will no entries in this section and it will show No Transactions Present

Part C of Form 26AS

Details of Tax Paid (other than TDS or TCS)If you have paid Advance Tax or Self Assessment Tax it will appear in this section.

Please verify that advance tax or self assessment tax details are showing up in Form 26AS, If they don’t match with your details please contact the Bank

Major and minor head codes used in Part C are given in image below. For Individual major code is 0021 and minor codes are 100 for Advance Tax and 300 for Self Assessment Tax.

Part D of Form 26AS

If you have got any tax refunds in that assessment Year it would be listed under this section or If you have not received any tax refund then there will no entries in this section and it will show No Transactions Present

PART E of Form 26AS

If you make some high value transactions, such as investment in property and mutual funds, then these transactions are automatically reported to the income tax department by banks and other authorities through Annual Information Return (AIR) . Click on image to enlarge

Email already exists.