ITR 2 Form

ITR-2 Form:

ITR-2 Form is a very important form to file the income tax returns by Indian Citizens and Non- Residential Citizens with the Income Tax Department.

Eligibility for ITR-2 Form:

This income tax return form is used by HUFs and Individuals to file their income tax returns whose source incomes are:

- Salary or Pension.

- House Property.

- Capital Gains (Short and Long term)

- Other Sources (Lottery Winnings, bets on Race Horses and other legal methods of gambling)

Structure of ITR-2 Form:

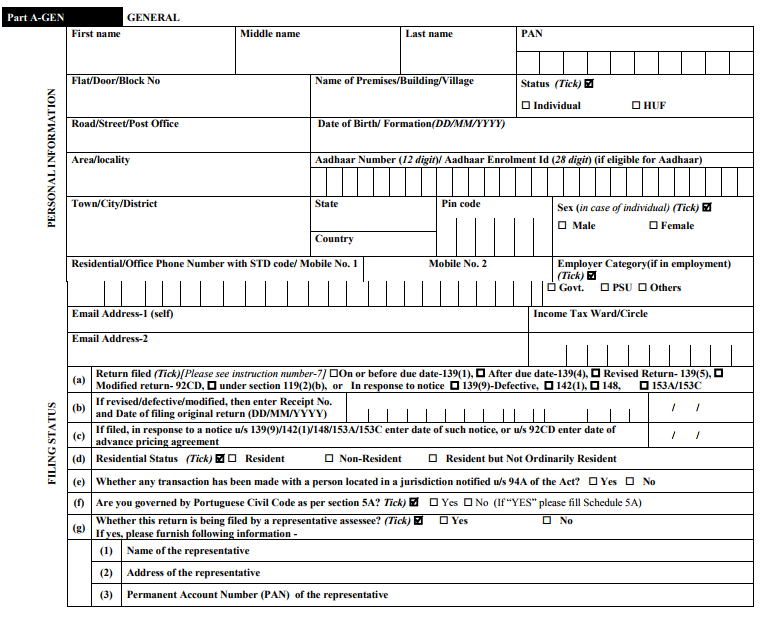

Part A-General Information:

Part B-T1 (Computation of Total Income)

Part B-TT1(Computation of tax liability and total Income)

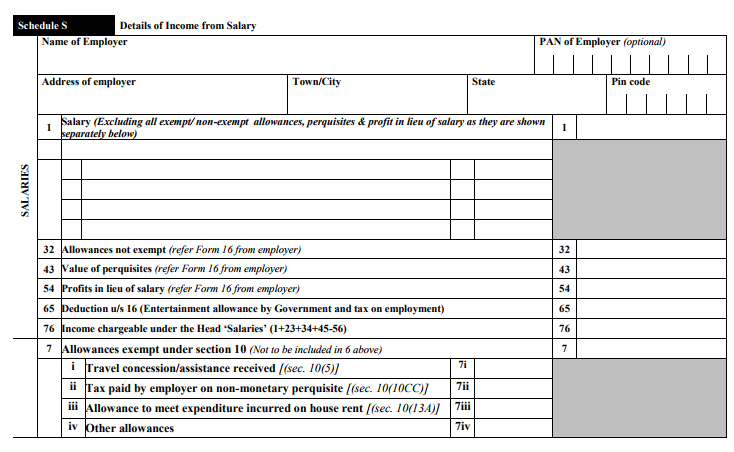

Schedule S (Details of Income from Salary):

Schedule HP (Details of Income from House Property)

Schedule IF (Information regarding partnership firm in which you are partner)

Schedule BP (Details of Income from Firms of which partner)

Schedule CG (Capital Gains)

Schedule OS (Income from other sources)

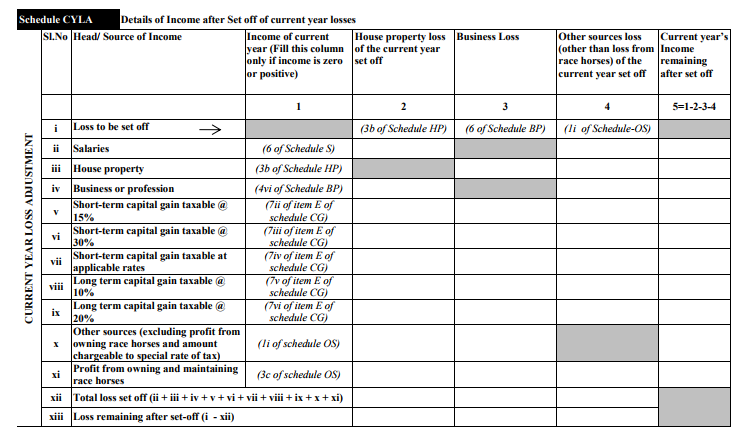

Schedule CYLA (Details of Income after Set off of current year losses):

Schedule BFLA ( Details of Income after Set off of Brought forward losses of earlier years)

Details CFL (Details of losses to be carried forward to future years)

Schedule VI-A (Deductions under chapter VI-A)

Schedule 80G (Details of donations entitled for deduction under Section 80G)

Schedule SPI

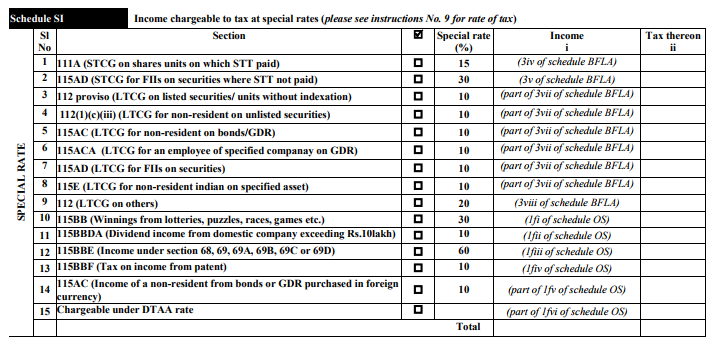

Schedule SI (Income chargeable to tax at special rates):

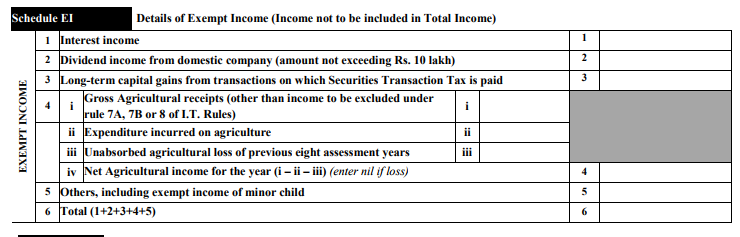

Schedule EI (Details of Exempt Income):

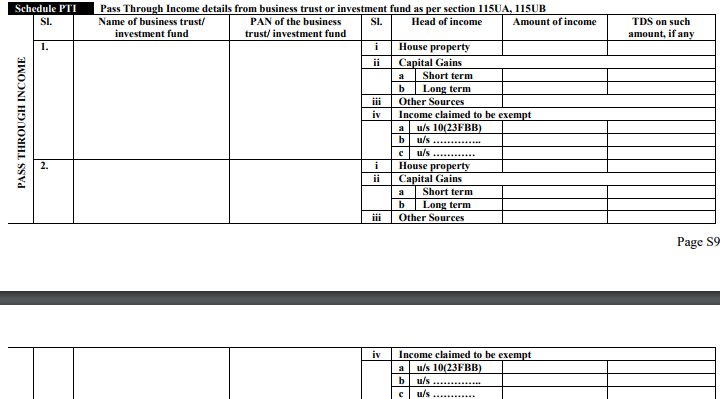

Schedule PTI:

Schedule FSI (Details of income from outside India and tax relief)

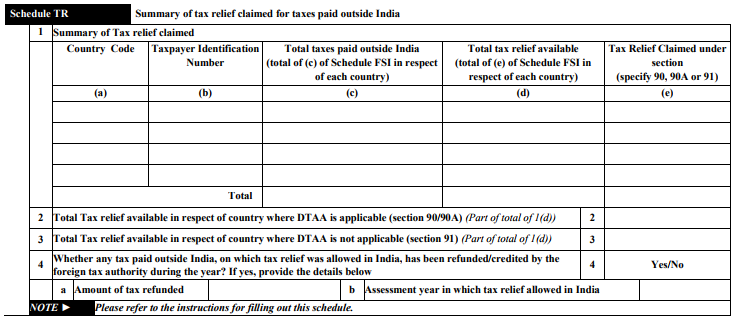

Schedule TR (Summary of tax relief claimed for taxes paid outside India):

Schedule FA (Details of Foreign Assets and income from any source outside India)

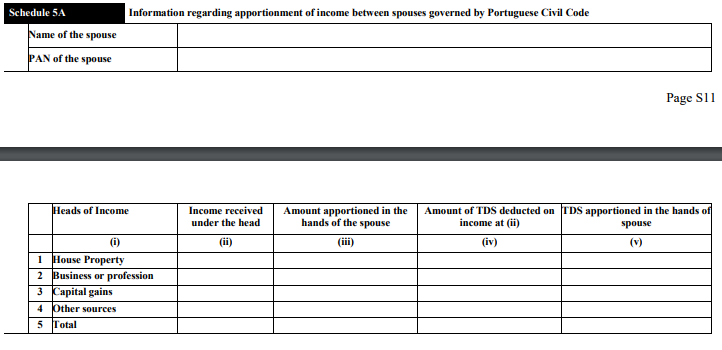

Schedule 5A (Information regarding apportionment of income between spouses governed by Portuguese Civil Code):

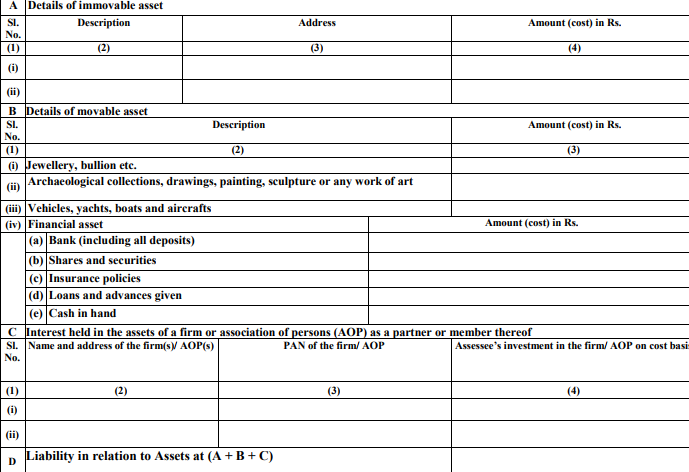

Schedule AL (Asset and liability at the end of the year in a case where total income exceed Rs.50 lakh):

Email already exists.