Income Tax Refund Status

Income Tax Refund starts after processing of income tax returns complete by income tax department. Once taxpayer file the income tax returns and verify it then processing of income tax returns starts by the income tax department.

During the processing of income tax returns department checks whether there is any discrepancy in returns or not. Once it is verified by the income tax department then status of ITR would be “Successfully Verified” or “ITR processed”. You can check this status anytime on e-filing website of Income tax department.

During the processing of income tax returns if department finds any discrepancy in your ITR then it sends the notice to the particular taxpayer.

Read more about the income tax notice in detail here: https://www.trutax.in/income-tax-notice

If in case there is any discrepancy in your returns then you will get the notice under Section 143 which will clearly mention the reason behind it.

Important points to know about the income tax refund status:

1.Refunds are processed in two ways which are direct credit or cheque.

2. In case of direct credit account number and IFSC code mention is mandatory in ITR.

3. If account details are not correct then refund will be processed through cheque payable to the account mention in the ITR.

4. You can check the income tax refund status of your ITR anytime on Income Tax Department website.

5. You need to issue request again on income tax website if refund not credited.

6. You can check the paid refund amount in form 26AS.

How to check Income Tax Refund Status online?

Once you have filed the income tax returns and verify it then income tax department start processing of your ITR. If you want to check the current status of your ITR then you can easily check it on income tax department website.

Steps to check income tax refund status Online:

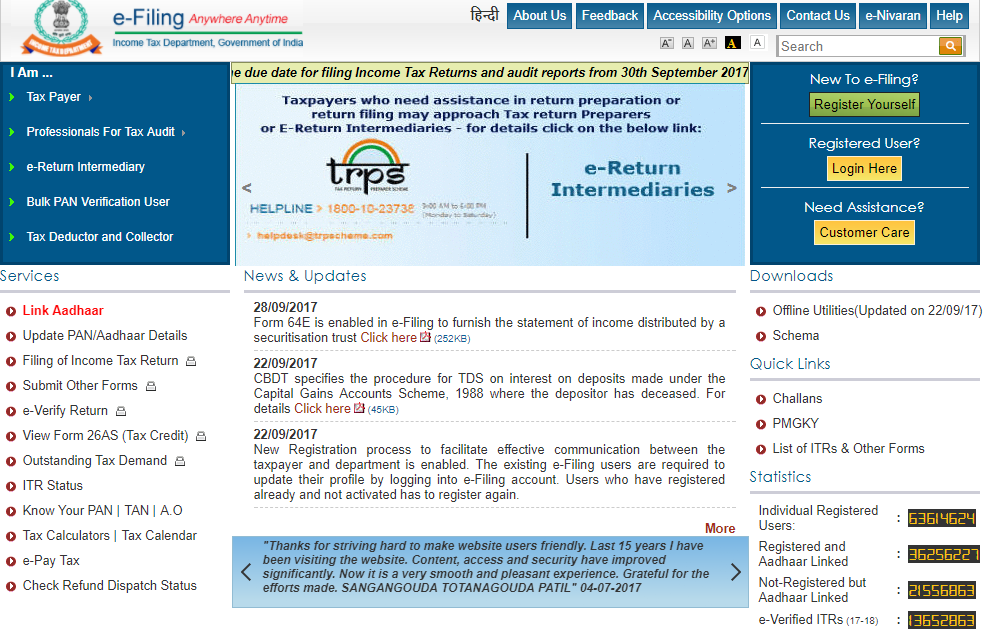

1. Click on ITR status on right hand side of income tax e-filing website.

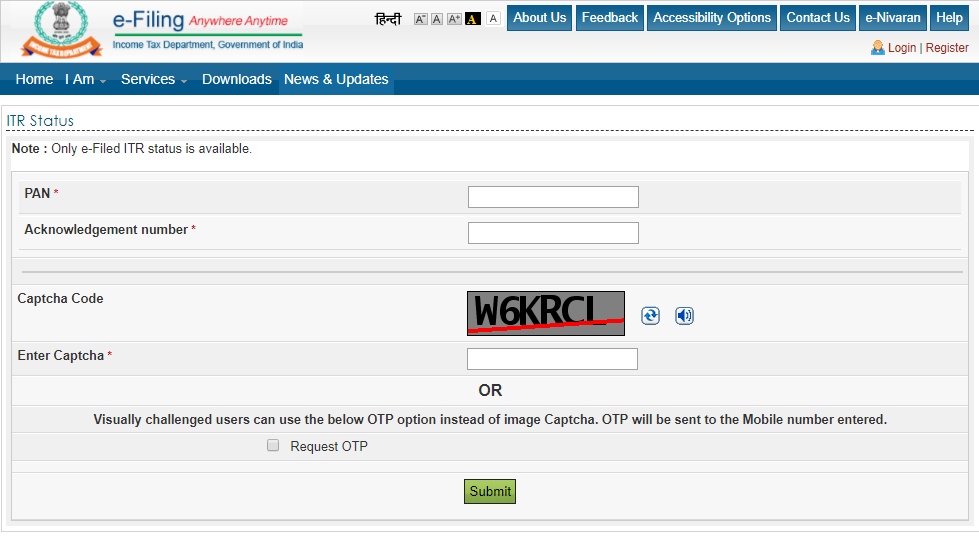

2. Once you will click on the “ITR Status” then you will be redirected to new page. Now you need to fill your details on form like PAN number and Acknowledge number.

3. After filling all the details, you will be redirected to new page and get your status as “Return Submitted and Verified”.

This is the simplest and easiest way to check your income tax refund status on income tax e-filing website.

Email already exists.