How to pay Due Tax

The last date for e-filing income tax returns notified by the income tax department is 31st July for individuals.

Step-by-step procedure to pay tax online

Step-1

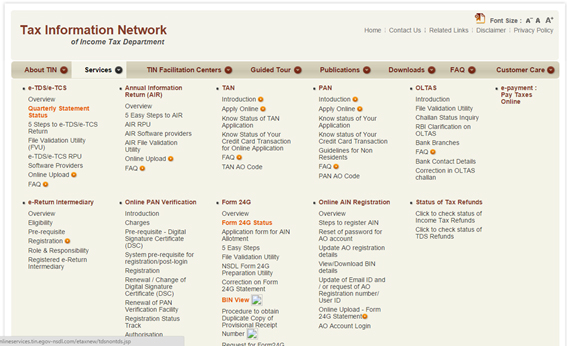

To pay taxes online, login to > Services > e-payment

Pay Taxes Online or click here on the tab "e-pay taxes" provided on the said website.

Step-2

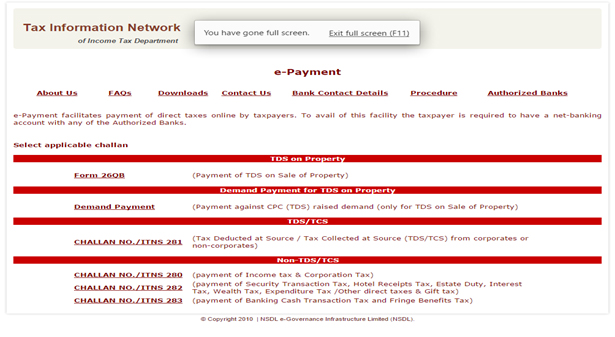

Select the relevant challan i.e. ITNS 280, ITNS 281, ITNS 282, ITNS 283 or Form 26 QB as applicable.

Step-3

Enter PAN / TAN (as applicable) and other challan details like accounting head under which payment is made, address of the tax payer and the bank through which payment is to be made etc.

Step-4

On submission of data entered, a confirmation screen will be displayed. If PAN / TAN is valid as per the ITD PAN / TAN master, then the full name of the taxpayer as per the master will be displayed on the confirmation screen.

Step-5

On confirmation of the data so entered, the taxpayer will be directed to the net-banking site of the bank.

Step-6

The taxpayer has to login to the net-banking site with the user id / password provided by the bank for net-banking purpose and enter payment details at the bank site.

Step-7

On successful payment a challan counterfoil will be displayed containing CIN, payment details and bank name through which e-payment has been made. This counterfoil is proof of payment being made.

|

Allahabad Bank |

Canara Bank |

IDBI Bank Limited |

State Bank of Bikaner & Jaipur |

State Bank of Travancore |

|

Andhra Bank |

Central Bank of India |

Indian Bank |

State Bank of Hyderabad |

Syndicate Bank |

|

Axis Bank |

Corporation Bank |

Indian Overseas Bank |

State Bank of India |

UCO BANK |

|

Bank of Baroda |

Dena bank |

Jammu and Kashmir Bank |

State Bank of Indore |

Union Bank of India |

|

Bank of India |

HDFC Bank |

Oriental Bank of Commerce |

State Bank of Mysore |

United Bank of India |

|

Bank of Maharashtra |

ICICI Bank |

Punjab National Bank |

State Bank of Patiala |

Vijaya Bank |

Email already exists.